How Global IT Spending Trends Impact Indian IT Players?

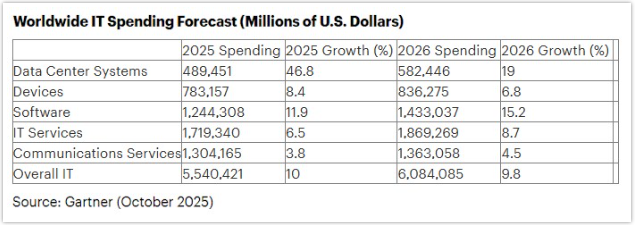

As per Gartner’s forecast, global IT spending by the end of 2025 will reach $5.54 trillion, making a 10% hike from 2024. This surge is driven by AI infrastructure and data centre systems. This growth is forecasted to continue in 2026 at 9.8%. Indian tech giants like TCS, Tech Mahindra, Wipro, and Infosys are expected to be beneficiaries of this.

It has been seen in the past that when there is a surge in global IT budgets for AI, Cloud, and cybersecurity, Indian companies capture a significant portion of the market. Conversely, when there is a recession in the global IT market, Indian firms get the worst hit among all.

Let’s unpack what this boom can mean to Indian IT Firms.

India’s IT Sector

The domestic IT industry in India is above the global average expenditure, and it is expected to cross $300 billion in FY2026.

The services exports remain one of the growth pillars of India. According to official statistics, computer and business services take a significant share in services export growth in the recent fiscal periods. This enhances the ability of the Indian firms to invest in upskilling, research and development, and international delivery centres.

Key Global Trends Fueling Growth

As per Gartner’s report, Data centre systems will see the growth of 46.8% rise to $489.5 billion by the end of 2025 due to AI workload requiring advanced servers and storage facilities. A 11.9 % growth is expected in 2025 for software spending, with $1.244 trillion. Overall IT sector’s growth is expected to grow at 10% with $5.54 trillion.

It also projects that the growth of Data centre systems will decelerate to 19% in 2026. However, the general growth of the IT industry is projected to be at 9.8%, reaching $6 trillion. These benefit Nifty 50 companies from the IT industry, such as Tech Mahindra share price and more.

So what should the Indian IT players do?

These are some of the main things that Indian IT players can do.

Transform services into pre-made services

The Indian IT firms should not just do hourly billing or project-based billing, but they should develop their own tools, platforms, and solution packages. This will assist them in providing quicker services and gaining more value out of every client.

Develop a great AI and data technology base

International customers are investing in AI, automation, cloud and data environments. The Indian IT companies require teams that know about MLOps, data engineering and cloud cost optimisation in order to be able to provide the services that the clients are in search of.

Expand on-shore presence and enter into local partnerships.

Clients today prefer a mix of local (on-shore) and Indian (off-shore) delivery. Having small teams in client countries helps with trust, compliance, and project supervision, while India remains the main delivery hub.

Train workers constantly and retain talent.

Global Capability Centres (GCCs) and multinational enterprises are competing to get the same Indian technological talent. To remain competitive, IT companies should provide regular upskilling, certification, and excellent career development to staff to retain them longer and produce better results.

Diversify and expand into new industries.

There is an increase in digital spending in areas such as manufacturing, healthcare and retail media. To exploit such new opportunities, Indian IT companies should diversify their target beyond the traditional BFSI and telecom sectors.

Conclusion

The trends in global IT spending are a swelling tide that will be able to lift the Indian IT players, but only those companies that re-equip themselves to work at higher value and productize with outcome-oriented work will get the largest benefits.

The opportunity is large (cloud, AI, security), but success will depend on speed, talent and the ability to reframe delivery from cost arbitrage to strategic partnership.

Global IT spending trends often influence large Indian IT firms, and this can be clearly seen in movements in broader Nifty 50 stocks that are linked to the technology sector.