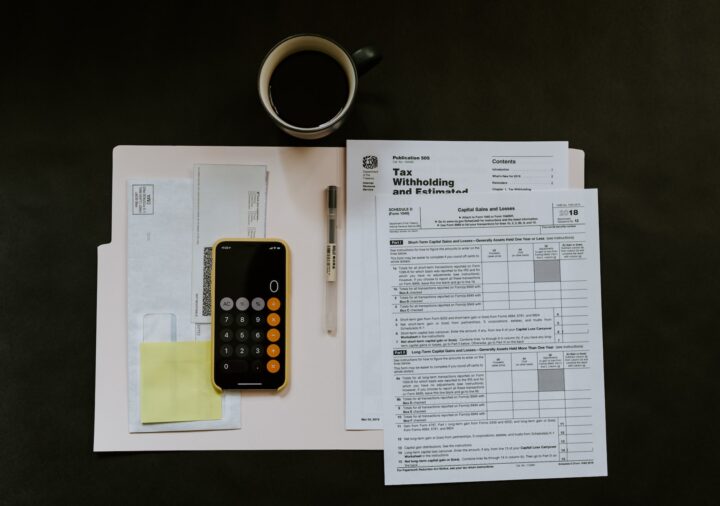

What to Pay Attention to When Looking for Tax Returns?

Tax season is here, and that means it’s time to start thinking about filing your taxes. Filing taxes can be daunting for many people, so it’s essential to understand what you should pay attention to when looking for tax returns. Knowing the correct information can help make filing easier and ensure you get all of the deductions or credits you are eligible for. Here are some key things to remember when preparing your tax return.

Know Your Tax Obligations

Before filing your tax return, ensure you understand what kind of taxes you owe and what deductions and credits are available. Make sure to research the different types of taxes that apply to your situation, such as income tax, sales tax, self-employment tax, etc.

Additionally, knowing which deductions and credits you qualify for is essential, so you don’t miss out on any potential tax savings. Make sure to research and understand the tax credits and deductions available, such as the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, Student Loan Interest Deduction, etc.

Study the Employee Retention Tax Credit Deadline

The ERC deadline is an important one to take into account when filing your taxes. The ERC is a tax credit that can help businesses struggling due to the pandemic by providing refundable payroll tax credits for employers that retain their employees.

Research the requirements and eligibility criteria to maximize your potential return. Additionally, submit the required documents on time to receive credit. Learn also about the COVID-19 effect on ERC Deadline. You want to maximize the potential benefit, so staying current on any changes is essential. There are reliable resources online that guide the details of the ERC and its deadlines.

Review Your Income and Expenses

There are instances when your income or expenses may have changed from the previous year. Make sure to review your past income and expenses for accuracy so that you are accurately filing your taxes. Pay attention to any changes in capital gains, investments, and other expenses that can affect your tax return.

Some expenses, such as charitable donations and medical bills, are tax deductible. Be sure to track these expenses throughout the year for accuracy when filing your taxes. Know that some income, such as capital gains, can be taxed at different rates than other forms of income.

Organize Your Documents

Ensuring you have all the necessary documents in order and organized is vital when filing your taxes. This includes W-2s, 1099s, receipts for deductions and credits, etc. Keep these documents safe throughout the year so you can easily access them when filing your taxes.

There are instances when you may need to submit additional documents with your tax return, such as copies of bank statements, mortgage statements, etc. File these documents early so you don’t miss out on any potential deductions or credits that could help reduce your tax liability.

Understand Tax Filing Software

This software makes the process easier and allows people to file their taxes quickly and accurately. Make sure to understand how the software works and that it is tailored to your individual needs before you start filing.

It’s essential to be aware of the potential fees associated with using tax filing software as well as any other services that may be required. Additionally, review your returns before submitting them to ensure that all information is correct.

Look Out For Errors

Make sure to double-check everything before you submit your return. Errors can lead to penalties and tax debt, so ensure all your information is accurate and up to date. Be aware of any tax laws or deductions changes, as these can lead to mistakes if you are not prepared.

There are times when the IRS may request additional information from you if they find errors or discrepancies on your return. Therefore, keep copies of all your documents if you are required to submit additional information.

Review Your Tax Withholding

It’s important to review your tax withholding throughout the year to ensure that you have enough money withheld from your paycheck for taxes. This helps ensure you don’t owe more than you can afford when filing your taxes.

Additionally, take any credits or deductions you qualify for to reduce your tax liability. Understanding the different forms of credits and deductions available is vital to maximizing your potential return.

There are many important details to pay attention to when looking for tax returns. Make sure you have your documents in order, understand the software you’re using, double-check the information for errors, review deadlines and withholding amounts, and take advantage of credits and deductions. By following these steps, you can ensure a smooth filing process.