Why Excel Is Critical for Success in Finance Banking and Accounting

Whether you’re a budding entrepreneur, an accounting major, or an experienced banker, chances are you’ve heard of Microsoft Excel. This powerful spreadsheet tool is indispensable for anyone in the finance, banking, and accounting industries—and for good reason.

From tracking financial transactions to forecasting future trends, this versatile program can do it all. It has become an invaluable asset to the banking industry so getting STL Training so you can easily work on excel is really important. Here are some reasons why Excel is critical to success in banking, finance, and accounting.

Data Management & Organization

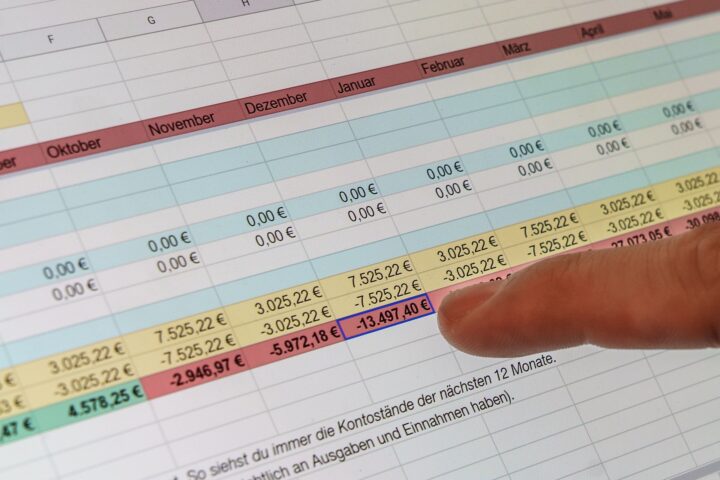

Excel makes it easy to store and organize large amounts of data. With its customizable spreadsheets, users can create tables with up-to-date information that can be sorted and filtered according to different criteria. This allows financial professionals to track past performance, identify trends and patterns in their data sets, and make more informed decisions about the future.

Excel is essential for working with data in banking and finance. Knowing your way around spreadsheets is key if you want to get ahead in the industry. If you want to learn about Excel or want to elevate your Excel skills to fit in with finance and banking, you can take Online Excel for Finance Courses. With a more structured understanding and developed skills, you’ll easily get to manage data and organize it for better use.

Data Analysis

One of the most important ways Excel is used in banking is through data analysis. By taking large amounts of raw data and organizing it into easy-to-read charts and graphs, bankers can quickly identify patterns or trends that may not have been apparent before. This allows them to make decisions based on real-time data, rather than relying on intuition or guesswork.

Excel also makes it easier to analyze large datasets that would otherwise take hours or days to process manually. This capability has allowed banks to become more efficient by providing them with faster access to valuable insights about their customers and operations.

Analytical Reporting & Visualization

Excel also enables users to quickly generate reports based on their data sets by using built-in formulas and functions. These reports provide a view into the performance of investments over time or help them identify areas of improvement in their business operations. As mentioned earlier, Excel allows users to craft charts and graphs from their data sets that make it easier to see trends or correlations between variables at a glance.

Forecasting

Financial models can be created using Excel that allow users to forecast future performance of investments or other financial instruments. These models are typically used by banks or investment firms when making decisions on purchasing new assets or allocating capital resources among various investments.

By leveraging the power of Excel’s formulas and functions, financial professionals can easily analyze large amounts of data quickly and accurately.

Automation

Excel also offers additional tools such as macros which allow users to record sequences of commands they frequently use so they don’t have to manually enter each command every time they need it executed.

This feature enables financial professionals to automate tedious (but important) tasks such as auditing accounts or creating budget projections with minimal effort involved in the process. Instead of manually fiddling around and wasting time, Excel’s automation features help you speed up the process without the hassle.

Conclusion

In summary, Microsoft Excel has become an essential tool for success in finance banking and accounting due its ability to manage large amounts of data efficiently; generate analytical reports; create forecasting models; and automate complicated tasks with macros.

As technology continues to evolve, there will no doubt be other applications that may rival Excel – but for now this powerful spreadsheet tool remains a critical part of any financier’s arsenal.