5 Ways AI in Fintech Is Revolutionizing Financial Businesses

The financial technology industry is built on being creative and shaking things up. Its main aim is to improve financial services using technology. Artificial intelligence is the star player in this regard, helping businesses offer more. Allied Market Research estimates that the artificial intelligence (AI) in the financial technology (Fintech) industry will grow from an initial 2021 valuation of $8.23B to $61.30B by 2031.

Benefits of Artificial Intelligence in Fintech for Companies

Artificial intelligence (AI) is a modern solution that mixes computer science with big data sets to solve problems well. In financial technology, AI helps companies make smarter decisions, which is critical in any industry.

AI-driven algorithms can sort through tons of data to find patterns and trends people might overlook. For example, on the MT4 trading platform, AI algorithms help build automated trading strategies by analyzing charts and market data to detect profitable opportunities. Here’s how businesses have taken advantage of AI and fintech solutions.

Automated Operations

Daily, organizations are charged with numerous tasks to ensure the smooth flow of their operations. With the help of AI, companies can automate these routine processes, allowing employees to focus on higher-priority activities. This is especially true for the customer service department.

These departments now have virtual assistants and chatbots powered by artificial intelligence because they improve customer service while cutting operational costs. They handle easy tickets with immediate, round-the-clock support, allowing employees to focus on complex support cases.

Virtual financial assistants are also another digital transformation trend employed by finance companies. Users can make more informed financial decisions with the help of these assistants. They make recommendations about forex or stocks to trade based on trends in stock and currency prices and events.

Artificial intelligence can also keep humans from making careless mistakes, potential errors, or inconsistencies that may get overlooked when analyzing data and patterns.

Knowledge-Based Decision Making

With AI and ML, companies can provide their staff with access to vast amounts of data. These state-of-the-art instruments can recognize patterns, predict results, and suggest actions. For example, AI-driven robo-advisors can help determine a client’s risk tolerance and financial goals to offer tailored investment advice.

While this was reserved for the well-off, now everyone may take advantage of these ideas. Due to the real-time evaluation of enormous datasets by AI-driven algorithms to identify risk indicators, FinTech businesses can issue credit and loans to more individuals. Quicker and more precise credit scoring is made possible by this.

Embracing a Focus on the Customer Way

Modern consumers have more authority than in the past. Research from the Qualtrics XM Institute in 2021 found that over 60% of customers would do business with companies that genuinely care about them.

Companies now provide highly customized services thanks to AI, and an integral part of this is ensuring that the customer’s journey is smooth and intuitive.

And, this is where fintech web design plays a crucial role. A well-crafted, user-friendly fintech design that’s tailored to meet customers’ needs can greatly improve their overall experience, making it easier for them to access services and confidently navigate complex financial tools.

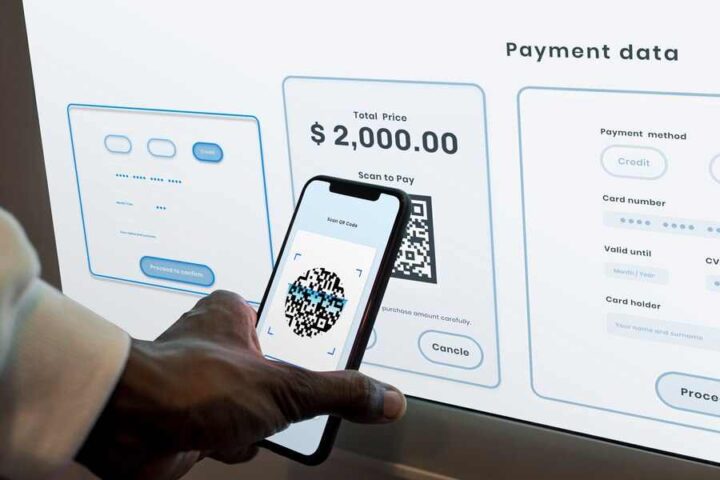

Also, AI algorithms can generate financing alternatives, investment strategies, and user-specific recommendations through data analysis and behavior.One of the main selling points is how convenient it is. Everything in finance, from banking and budgeting to loan applications and consumer satisfaction, has been transformed by portable technology in the payment industry.

For example, this is why, as more and more people use their phones and tablets for computing, e-commerce giants like Amazon have turned their attention to mobile availability. Similarly, AI in Fintech may also have a significant impact due to the potential insights derived from human-generated data.

Predictive Analysis and Fraud Detection

Companies can gain a significant advantage, enhance internal processes, and boost efficiency by constructing predictive models using historical patterns. One essential application is calculating credit risk. Artificial intelligence (AI) scoring models reduce bad loans by using alternative data to give deeper insights. This leads to lower costs and loan defaults offering a competitive edge for fintech lenders.

Another area where AI shines is detecting unusual user behavior and suspicious activity indicators. It can immediately identify and block various fraud schemes. Adaptive and robust anti-fraud systems are made possible by machine learning-powered systems that continuously use consumer data to refine predictive models. This is one area where financial software development really shines, using both AI and predictive data to keep people safe. Compared to older systems, they are better able to learn and detect new forms of fraud.

Algorithmic Trading

Over 70% of US equity trading volume is driven by algorithmic trading, as large financial institutions prefer to rely on intelligent algorithms rather than human intuition when making split-second decisions.

Insights derived from data and trades executed at lightning speed provide impossible consistency for humans to achieve. They can analyze market data, news stories, and statistical trends to construct prediction models that guide the best times and prices for currency and stock trades.

Retail traders have also embraced the automation and intelligence afforded by advances in Fintech. Platforms like Metatrader 4 enable traders to develop or use ready-made expert advisors — algorithms that automatically execute trades according to pre-defined market conditions and custom strategies.

The Customer Engagement Power of AI and Fintech

There is no denying the influence AI and Fintech have on companies. Enhanced productivity and a more pleasant user experience are outcomes of its user-friendliness, automation, and efficiency. Their assistance allows businesses to reach a wider audience and cultivate long-term customer connections.

This, in turn, ensures a consistent flow of revenue for the company by making clients loyal. The most intimidating or promising prospect? We have yet to begin to scratch the surface of AI’s potential in this industry.